What is AI in Accounting?

Artificial Intelligence (AI) is a broad term that encompasses various technologies and techniques used to enable machines to perform tasks that would typically require human intelligence. AI in accounting is the application of these technologies and techniques in the field of accounting to automate processes, perform data analysis, and help make informed financial decisions.

AI can be implemented in various areas of accounting such as auditing, tax preparation, risk assessment, fraud detection, and financial reporting. Here are a few examples:

Data entry and processing: AI-powered software can extract data from documents, such as receipts and invoices, and accurately input it into financial systems. This reduces the need for manual data entry by accountants, saving time and reducing the risk of errors.

Predictive analytics: With large datasets and advanced algorithms, AI can analyze patterns and trends in financial data to make predictions about future outcomes. This enables accountants to make more informed decisions based on accurate forecasts.

Fraud detection: AI can detect anomalies and flag suspicious transactions, reducing the risk of fraudulent activities going undetected.

Process automation: Repetitive tasks like bank reconciliations and invoice processing can be automated through AI, freeing up accountants' time to focus on more complex tasks.

Overall, AI in accounting aims to streamline processes, reduce costs, and improve accuracy and efficiency.

Key Benefits of AI in Accounting

AI in accounting is becoming increasingly essential for the industry's competitiveness and survival.

In fact, according to The State of AI in Accounting Report 2024 by Karbon Magazine, 71% of respondents believe that AI will bring about a big change to their operations.

To explore the potential prospects of AI, let's look at some benefits it may provide to your organization.

1. Automation of repetitive tasks

AI technology is excellent at anything that requires repetition.

Therefore, AI can automate time-consuming accounting tasks such as data entry, invoice processing, and account reconciliation.

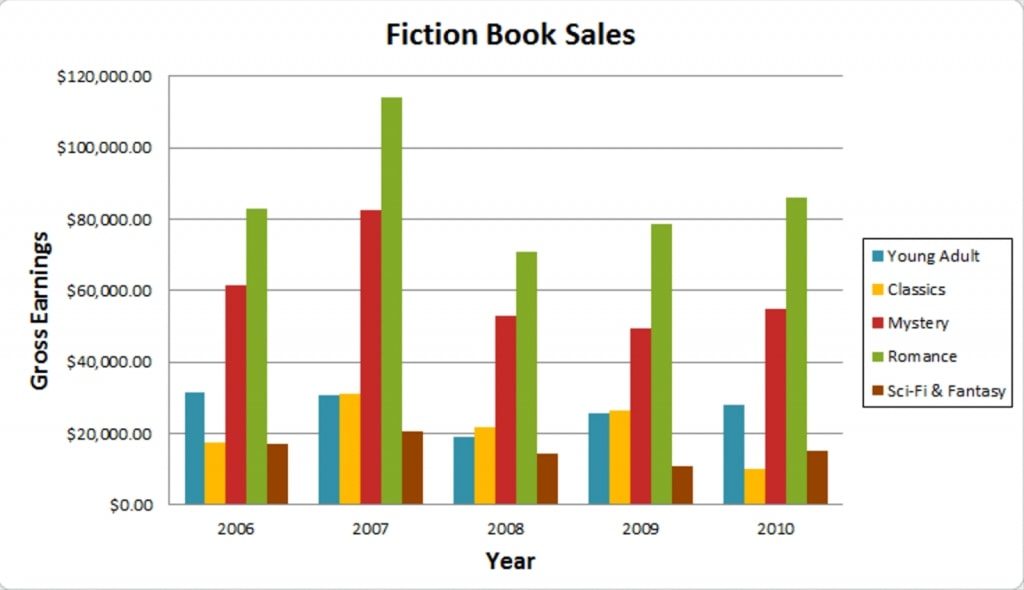

According to a report by McKinsey, many functions within finance and accounting can be automated.

As you can see from the image above, the general accounting operations sub-function has the highest proportion of tasks capturable by current AI technologies.

Companies adopting AI for automation purposes can free up accountants' time to focus on high-impact, strategic activities like financial analysis.

For example, AI-driven systems can automatically categorize transactions, reconcile accounts, and even generate financial statements, significantly reducing the manual effort required. A software company, Accountancy Cloud, has developed AI solutions to automate language or text-based tasks for their clients.

2. Improved accuracy and reduced errors

One of the significant advantages of AI in accounting is its ability to reduce human error. Tasks like bookkeeping and financial reporting can be error-prone when managed manually.

AI minimizes these risks by ensuring consistent data accuracy, which enhances the reliability of financial reports. This precision is crucial for businesses that rely on accurate financial data to make critical decisions.

3. Real-time financial insights

AI empowers businesses with real-time financial data analysis, allowing them to make quicker, informed decisions based on up-to-the-minute financial metrics.

Traditional accounting processes often delay reporting, but AI-driven platforms analyze data continuously, giving organizations immediate insights into cash flow, expenditures, and profitability.

According to J.P. Morgan, AI has the potential to revolutionize cash flow forecasting with AI through the analysis of enterprise data platforms, online media, and regulatory changes.

4. Cost savings and scalability

Adopting AI can lead to considerable cost savings as well. Time and resources spent doing extensive manual work can be saved, allowing organizations to operate with leaner accounting teams.

AI systems can handle massive datasets efficiently, enabling companies to scale their financial operations without a proportional increase in resources.

For example, an Artificial Intelligence Central Europe CFO Survey 2019 by Deloitte found a 40% improvement in effectiveness and 46% in cost reduction in companies that implemented AI for accounting.

How AI is Used in Accounting

The use of AI is relatively new to accounting, but the applications are already making an impact on the industry.

Here are some real-life examples of AI in accounting:

1. Fraud detection and risk management

AI plays a crucial role in detecting fraud by analyzing vast volumes of financial data to identify anomalies and suspicious transactions.

Advanced AI algorithms can:

Assess patterns

Recognize irregularities

Alert accountants to potential fraud

These help to mitigate fraud within an organization.

For example, a bank partnered with Cognizant to create an AI neural network to identify fraudulent checks, saving $20M in fraud losses.

2. AI in auditing

AI also has the potential to transform the audit process. Traditionally labor-intensive tasks can be streamlined through the use of AI.

This is done by analyzing large datasets, reducing the need for manual sample testing, and identifying trends and anomalies that might go unnoticed by human auditors.

This allows auditors to focus on areas requiring professional judgment, thus enhancing the quality of audits.

However, this doesn’t mean the auditor is not involved in the process. According to KPMG, 64% of survey respondents expect auditors to conduct a more detailed review of the control environment in relation to their use of AI. This means that auditors are still required to govern and manage their use of AI in audits.

3. Predictive analytics for financial forecasting

AI-driven predictive analytics enable accountants to forecast future financial performance and trends with greater accuracy.

Analysis of historical data and external factors can enable AI models to project revenue, cash flow, and other financial metrics, aiding in budgeting and strategic planning.

4. Generative AI in financial reporting

Generative AI tools, such as language models, simplify the process of drafting financial reports and performing competitor analysis.

These tools can analyze vast amounts of information, generate summaries, and create automated communications, enabling accountants to produce high-quality reports efficiently.

For example, AI can be used for invoice processing, where it can automatically extract and categorize data from invoices, eliminating the manual effort required.

6 Comments

Dinesh Kundu

January 05, 2025Analysis of historical data and external factors can enable AI models to project revenue, cash flow, and other financial metrics, aiding in budgeting and strategic planning.

Subham Ghosh

January 05, 2025yes same2you bro!

Dinesh Kundu

January 05, 2025Thank You @Subham

Surojit Das

January 05, 2025Generative AI tools, such as language models, simplify the process of drafting financial reports and performing competitor analysis.

Babay Das

January 05, 2025These tools can analyze vast amounts of information, generate summaries, and create automated communications, enabling accountants to produce high-quality reports efficiently.